My Trade Journaling Framework: How I Track Edge Over 100 Trades

Why Journaling Matters More Than Charts

Most traders obsess over finding the “perfect setup.” Few track what actually happens when they trade it.

The truth? If you’re not journaling, you’re guessing.

Trading is a probability game. Your edge doesn’t show up in 5 trades or even 20. It shows up across 50, 100, 200 trades. The only way to see it is through consistent journaling.

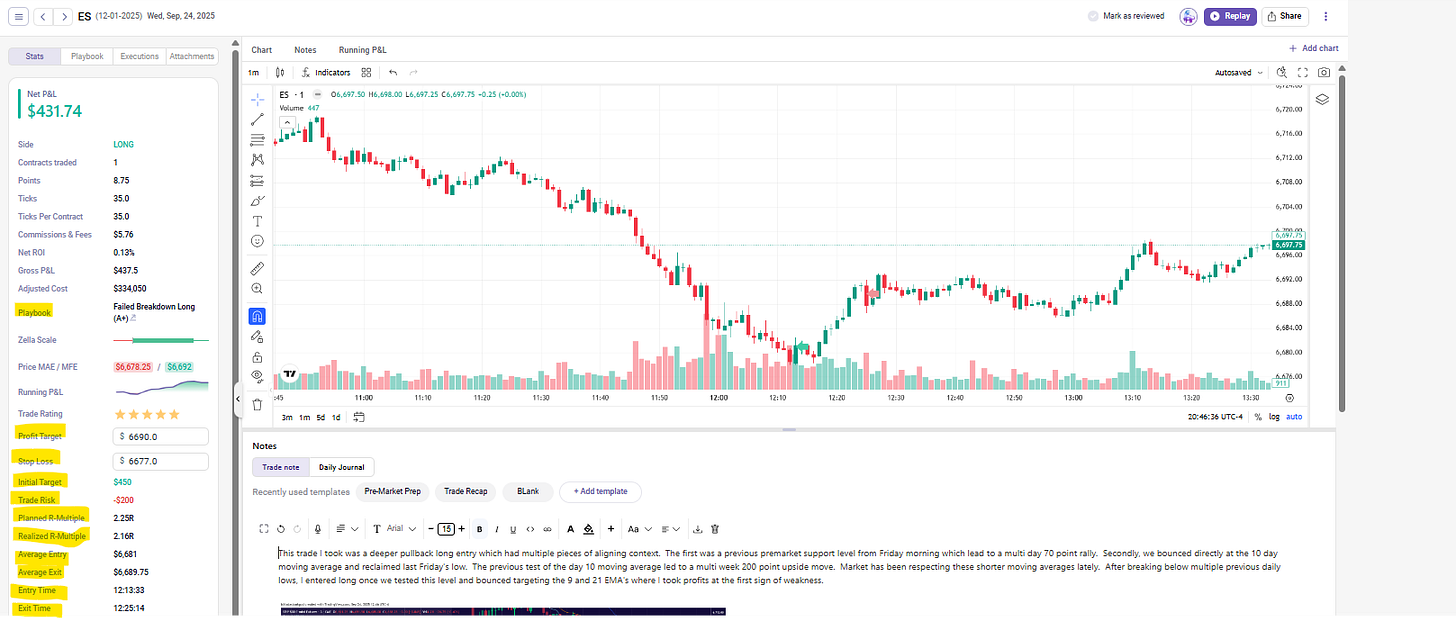

This is how I track my edge and how you can steal the framework. Whenever I want to add a setup to my repitoire, I prioritze that setup and test it over the course of 100 trades. And only after those 100 trades do I evaluate that setup in depth to decide if it is worth adding to my arsenal.

What a Trade Journal Should Do

A proper trading journal does 3 things:

Captures Data → So you can measure risk/reward, win rate, expectancy.

Reveals Patterns → Which setups actually pay, which ones bleed you out.

Forces Reflection → Keeps you accountable and stops you from making the same mistake 20 times.

If you’re missing one of those, you’re journaling for the sake of “feeling organized,” not for actually improving.

My Journaling Process Step-by-Step

Step 1: Capture the Trade Immediately

Right after execution, I log:

Setup type (failed breakdown, trend pullback, etc.)

Entry & exit levels

Stop placement

Planned vs actual risk

Step 2: Review Daily

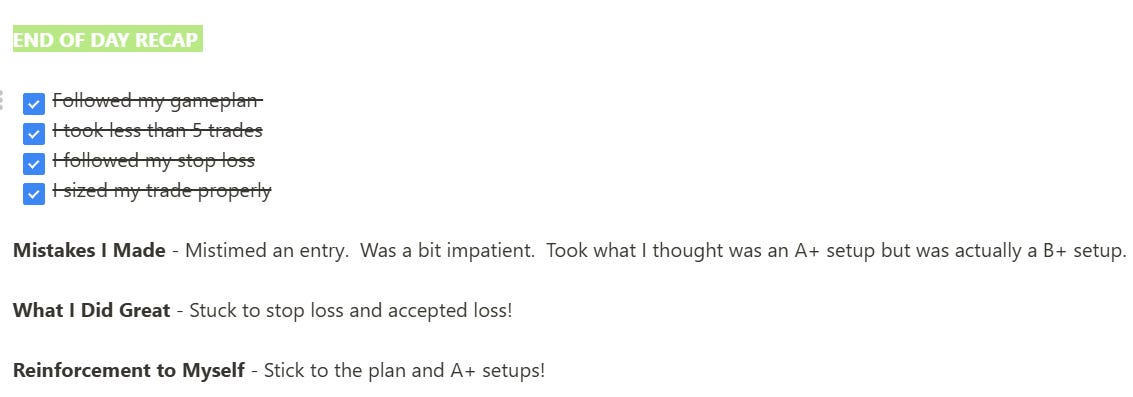

At the end of the day, I tag each trade:

A+ setup? Or boredom? Was there a setup at all?

Did I follow my rules?

Notes on psychology (was I patient, emotional, tilted?).

🔥 This is where most traders stop journaling. They track data for a week or two, then quit. That’s why they never actually see if they have an edge.

Paid subs get my full framework…the exact templates I use, my key metrics, and the reflection questions that have sharpened my edge over thousands of trades.

Keep reading with a 7-day free trial

Subscribe to BlitzDaStonkGod’s Substack to keep reading this post and get 7 days of free access to the full post archives.